Social Investing: What is it?

May 03, 2011 | Adam Fish

Back to Articles | Previous Page

Related Finance Topics | Social Finance

Social investing has received a lot of interest in recent years — especially following the financial crisis. Most people, however, are left wondering: What is social investing? Let’s answer this question.

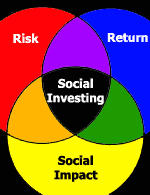

To understand what social investing is, we must first consider how traditional investors look at the world. In traditional investing, investors weigh investment decisions by looking at two broad factors — risk and financial return.

Risk, Return — and Social Impact

Each investor has a certain comfort level across the risk-return spectrum, and he or she does their investing within that band of the spectrum. An investor might be comfortable giving up some of their return if an investment is safer. On the other hand, the same investor might be willing take a little more risk with an investment if it translates into a higher return.

In social investing, a third factor is thrown into consideration — social impact. Social impact means that the enterprise supported by the investment yields some benefit to society beyond the income it generates for investors. Conversely, an enterprise can also have some negative impact on society, and a social investor will also take this into consideration when making investments.

Just as traditional investors are willing to make a tradeoff between risk and return, social investors are willing to make a tradeoff between risk, return and social impact. If an enterprise is doing something that’s improving the environment, for example, a social investor may be willing to give up some financial return or assume greater risk on that investment depending on his or her individual comfort level.

In short, social investing can be defined as considering the social impact of an enterprise when making investment decisions. By this standard, a number of investment approaches fall under the umbrella of social investing: mission investing, responsible investing, double-bottom-line investing, triple-bottom-line investing, ethical investing, sustainable investing and green investing.

Social Screening

Within the universe of social investing, there are two broad categories: social screening and impact investing. In the social screening methodology, an investor comes up with a list of social standards that he or she wants his or her investments to meet.

The investor eliminates any company that does not meet these standards and then invests in the “socially responsible” companies that do meet the standards in a way that meets the investors risk and return objectives.

A number of socially responsible mutual funds have emerged that use such an approach. They adopt a social screening methodology, define large basket of investments that adhere to those standards and then have their management company invest within that basket to meet the financial objectives of the mutual fund.

Some well-know social investment mutual fund companies include:

Calvert Mutual Funds

Domini Mutual Funds

MMA Praxis Mutual Funds

Neuberger Berman Mutual Funds

Parnassus Investments

Pax World

TIAA-Cref

Impact Investing

The second broad category of social investing is known as impact investing or, sometimes, community investing. In impact investing, rather than investing in companies that do no harm, investments are made in companies that do social good.

Enterprises that fall under the impact investment heading perform services that have a charitable or social purpose but also have a business model that can generate income and support a financial investment. They straddle both the charity and business worlds.

Impact investment enterprises might be structured as non-profit or for-profit companies but rarely do they take the form of the large public companies listed in the capital markets. As a result, making an impact investment is more difficult and usually takes the form of a private investment in the form of a note or loan.

Impact Investment Sectors

So what exactly are these impact investment enterprises? To get a better sense, let’s look at some of the sectors that qualify as impact investments.

Affordable housing is one sector familiar to most people. Most people support an organization like Habitat for Humanity by making donations, but foundation, for example, might support them by providing a low interest loan to fund the organization’s projects.

Microfinance is another impact investment sector. A microfinance institution makes small loans to entrepreneurial people in developing countries to give them the opportunity to start or grow their own business and lift themselves out of poverty. A microfinance institution works similar to a bank, so it is able to generate income and support investors.

There are many other similar sectors that generate income and have a social mission at their core: fair trade, community development organizations, social enterprises, etc. In each sector, companies can often find investors who are willing to give up some financial return or take on a bit more risk because of the social impact that these organizations have.

Back to Articles | Previous Page

This web site is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any securities. The author has taken all usual and reasonable precautions to determine that the information contained in this website has been obtained from sources believed to be reliable.