JM Hurst: A Forgotten Founder of Cyclic Technical Trading

July 26, 2011 | Tom Cleveland

Back to Articles | Previous Page

Related Finance Topics | Capital Markets | Financial History

Is it time for JM Hurst to be recognized for bringing “rocket science” to bear on the world of technical analysis? Guest contributor Tom Cleveland explores the question.

For traders that are interested in learning about the history of technical analysis, they soon discover that there is a “Holy Trinity” of principles that form the foundation of this analytic art form.

These principles include: price is the representation of all market forces, price behavior often occurs in repeating patterns, and prices tend to move in trends.

When the topic of market cycles and correlations to similar actions in Nature is mentioned, the names of Ralph Nelson Elliott and WD Gann quickly come to mind as the progenitors of modern technical theory.

While both of these men made invaluable contributions to “TA” based on years of thoughtful analysis, their work stems from the Great Depression era, but they are not the only ones to make great strides in analyzing trends and their cyclical characteristics.

JM Hurst, a physicist and aerospace engineer, is rarely cited with the other members of this formidable “triad”, but his work carried insights of market cycles to a new level. As an engineer, he was trained to adapt real-life models to academic hypotheses.

With his experiential background, it was predictable that his interests would bridge over to market dynamics and their cyclical nature.

In the early 1970’s, he expended over 20,000 hours of computer time dissecting the vagaries of stock market data.

He published a book on the topic in 1972 and followed with a “1,500+”-page course of study that revealed the secrets that supported his claims of 90% success rates while trading stocks.

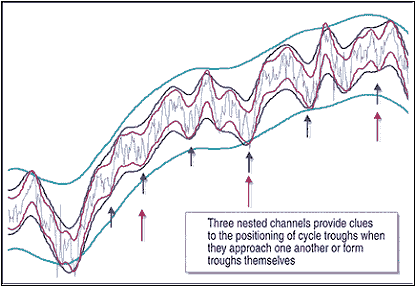

One aspect of his work deals with “nested channels” as depicted in the diagram below:

In typical scientific fashion, Hurst proceeded to subdivide pricing behavior into clearly defined components of trend, cycle, and noise.

His principles carry on from there to suggest optimum trading strategies for any market, whether they are securities, commodities, or currencies.

Forex brokers may provide the latest in technical trading platforms, but none will disclose a clear law that governs the cyclical nature of various currency pairs, the “EUR CHF” pair for example.

The Euro and “Swissie” are closely correlated, but their nuances take time to discover.

The reason that the name “Hurst” in not in our daily lexicon is due to an ironic twist of fate. The release of his classic materials occurred during one of the deepest bear markets since the 1930’s.

A shy person at heart, Hurst withdrew into obscurity, never to be heard from again. However, historians and educators alike have found his work, and there are websites dedicated to his contributions, offering software that embodies his principles and enhances his ideas with more recent developments from other studies.

Does the Hurst process work? For those traders that invested the time to learn his principles and wade through his voluminous course of study, the place where his real secrets are located, his supporters swear that he was onto something.

Critics are not so sure, generally professing a lack of desire to invest the time necessary or declaring that the methods are far too complex.

It is difficult to find definitive explanations for how the Hurst process works. Specialized software is needed to perform the graphical analyses, a “must have” if you wish to test out these theories.

The pitfalls disclosed by a few traders resemble similar critiques heard about Gann charts and Elliott waves. The process is too complex, beginnings and endings of cycles are difficult to detect, and pattern recognition seems more an art form than a discipline.

It is time for JM Hurst to be recognized for bringing “rocket science” to bear on the world of technical analysis. His contributions have been overlooked.

Back to Articles | Previous Page

This web site is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any securities. The author has taken all usual and reasonable precautions to determine that the information contained in this website has been obtained from sources believed to be reliable.